Case study

Frávega Pay

Company:

FrávegaTech

Year:

2024/2025

Country:

Argentina

Industry

Fintech

0.0

Context

Context

Frávega Pay represents the financial bet of Frávega, one of Argentina’s most traditional retail companies.

Its goal: to digitize a historically physical financing model by offering a prepaid card with personal credit.

1.0

Challenge

Entering the fintech domain

The challenge was clear: breaking into a fintech market already dominated by giants such as Mercado Pago, Ualá, and Naranja X.

Frávega chose to transform its traditional model into a fully digital product—capable of scaling rapidly and becoming a strategic pillar of the company.

From traditional credit to a digital financial experience

Launching the Friends & Family stage

The Friends & Family phase was critical to test whether the product was ready to grow. The goal was to validate the core functionalities:

Apply for credit

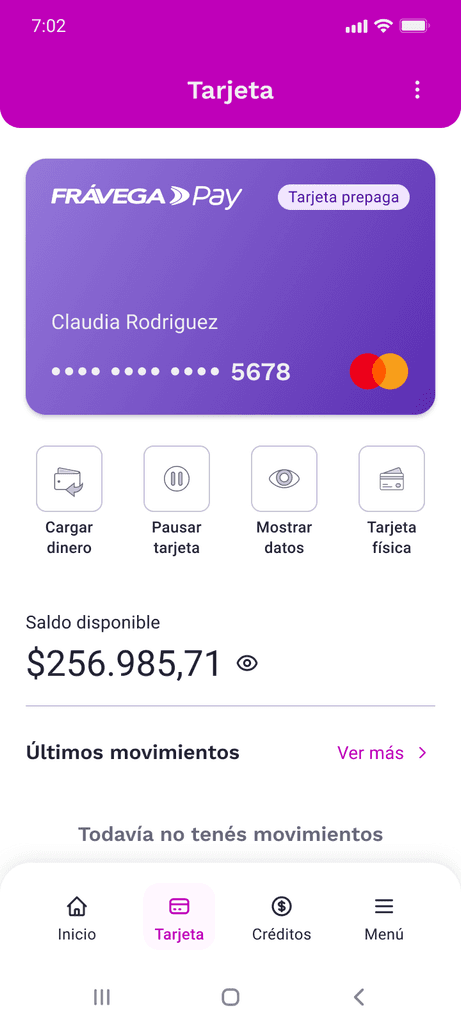

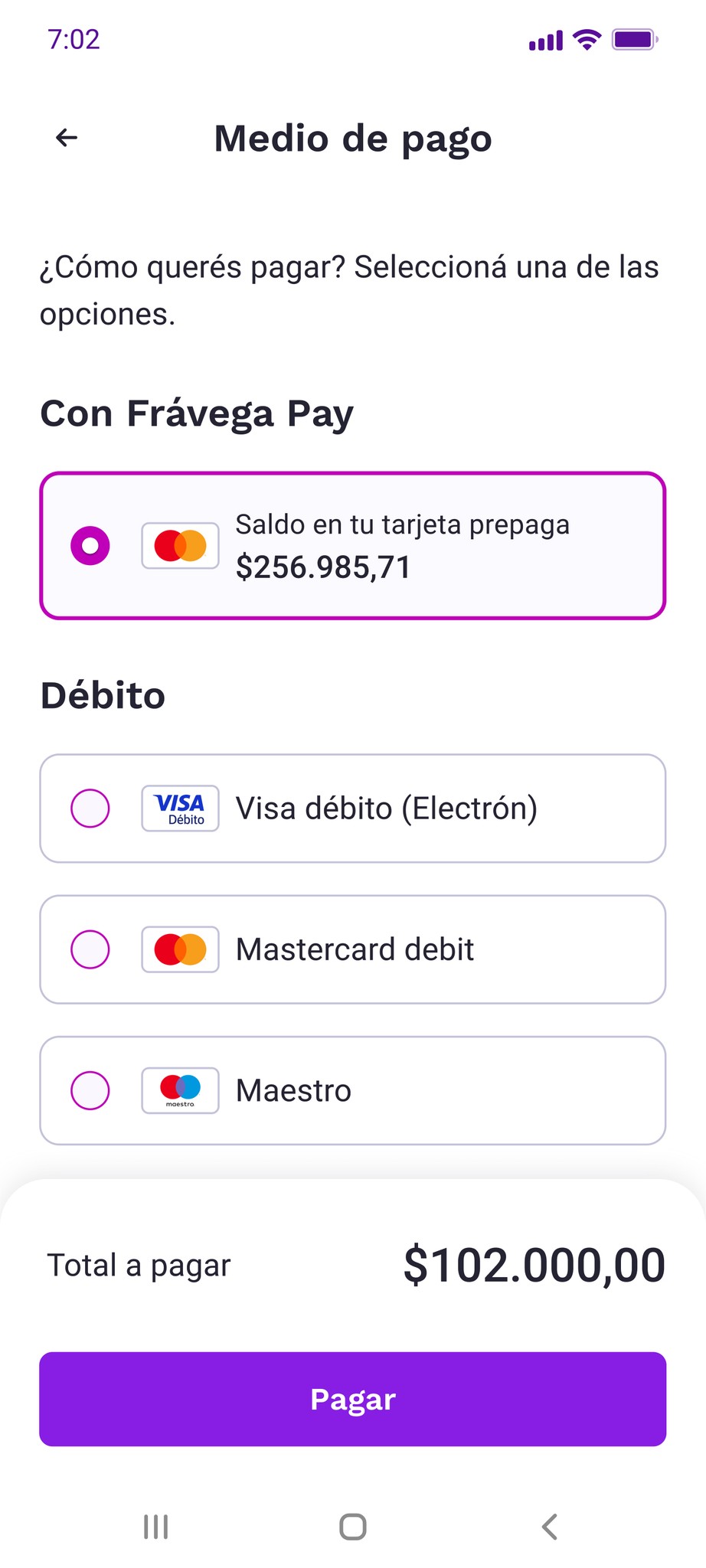

Prepaid card &purchase

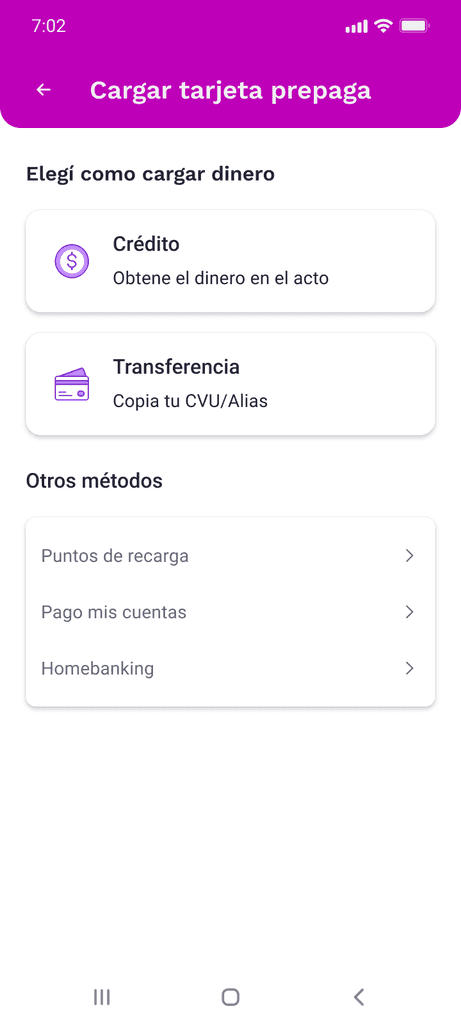

Load balance

Beyond technology, the main challenge was cultural: creating a smooth and trustworthy experience for users accustomed to semi-in-person procedures, now facing for the first time a fully digital financial solution.

2.0

Research

Research

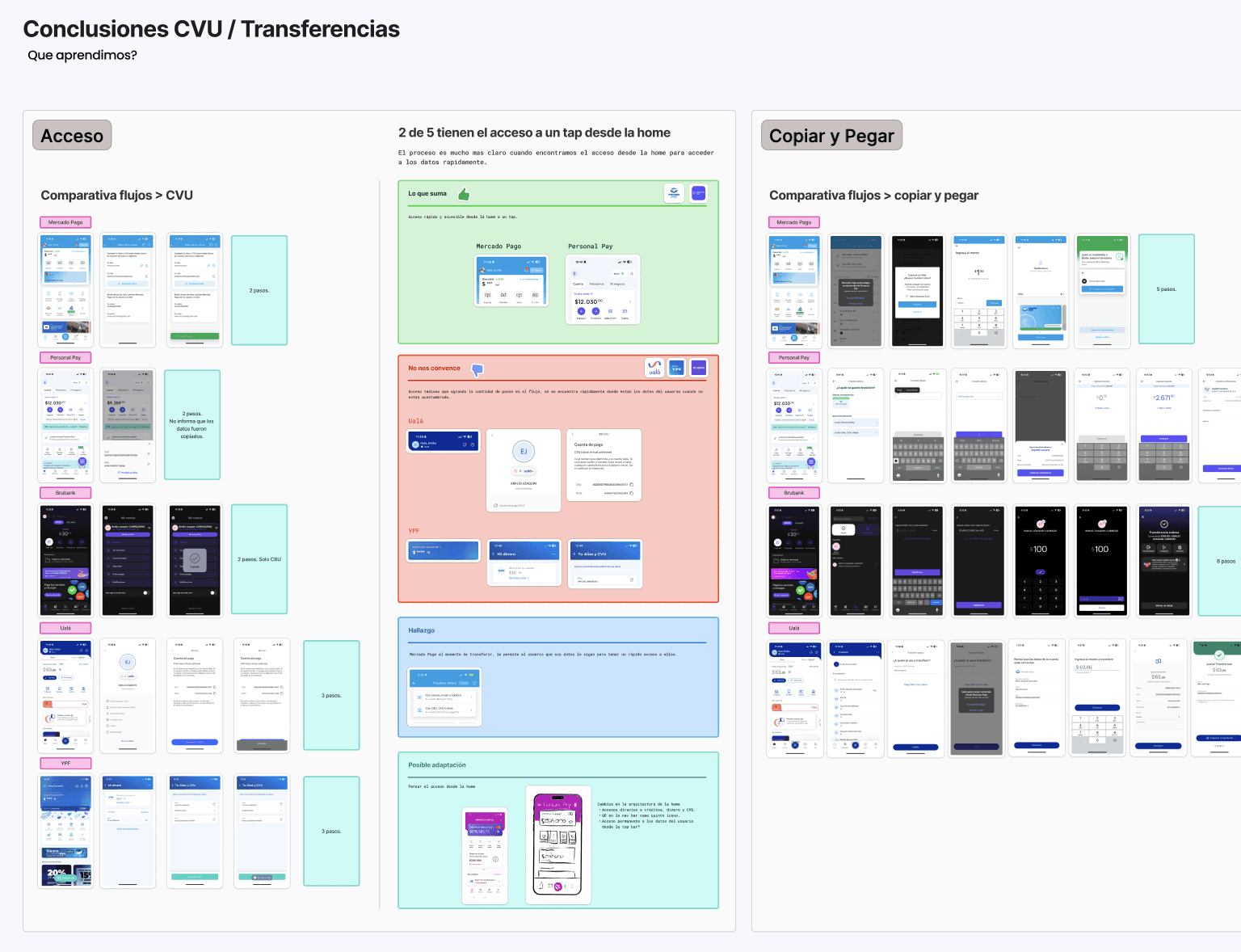

To validate the MVP, it was essential to understand how Frávega’s users perceived credit and what was holding them back from transitioning to digital. Interviews and benchmarks revealed clear frictions and design opportunities:

Key user findings

85%

Physical Credit was still perceived as a physical procedure, often linked to visiting a branch and signing paperwork.

Speed

Speed Reducing friction in onboarding and during the first digital credit request was critical.

80%

Limited use Customers could only use Frávega credit for in-store purchases, but they demanded more freedom of use.

Time

Time & place restrictions Credit applications could not be made at the moment of purchase, only managed at the branch.

Benchmark

Balance Top-Up

Alias/CVU became the industry standard; adopting it was essential to remain competitive.

QR Payments

QR codes are a daily habit in the Argentine market.

Installments

Absolute transparency on installment amounts, due dates, and repayment terms was non-negotiable.

Objective Impact

The challenge went beyond digitizing credit: it was about designing a financial experience ready to compete. That meant prepaid cards, aliases, QR payments, and transparent installment management. A product built for everyday use—not only for shopping at Frávega.

3.0

Process

From Insights to Design

Research insights paved the way for a clear direction: we needed to design a product that inspired trust from the very first interaction, simplified access to credit, and laid the foundation for more robust functionalities in the future.

Wireframes

The process began with low-fidelity wireframes to validate structure and interaction logic, gradually evolving into mid-fidelity versions to define hierarchy, components, and user feedback in each action. These iterations helped align design, business, and development before reaching the final UI.

4.0

Design

Design

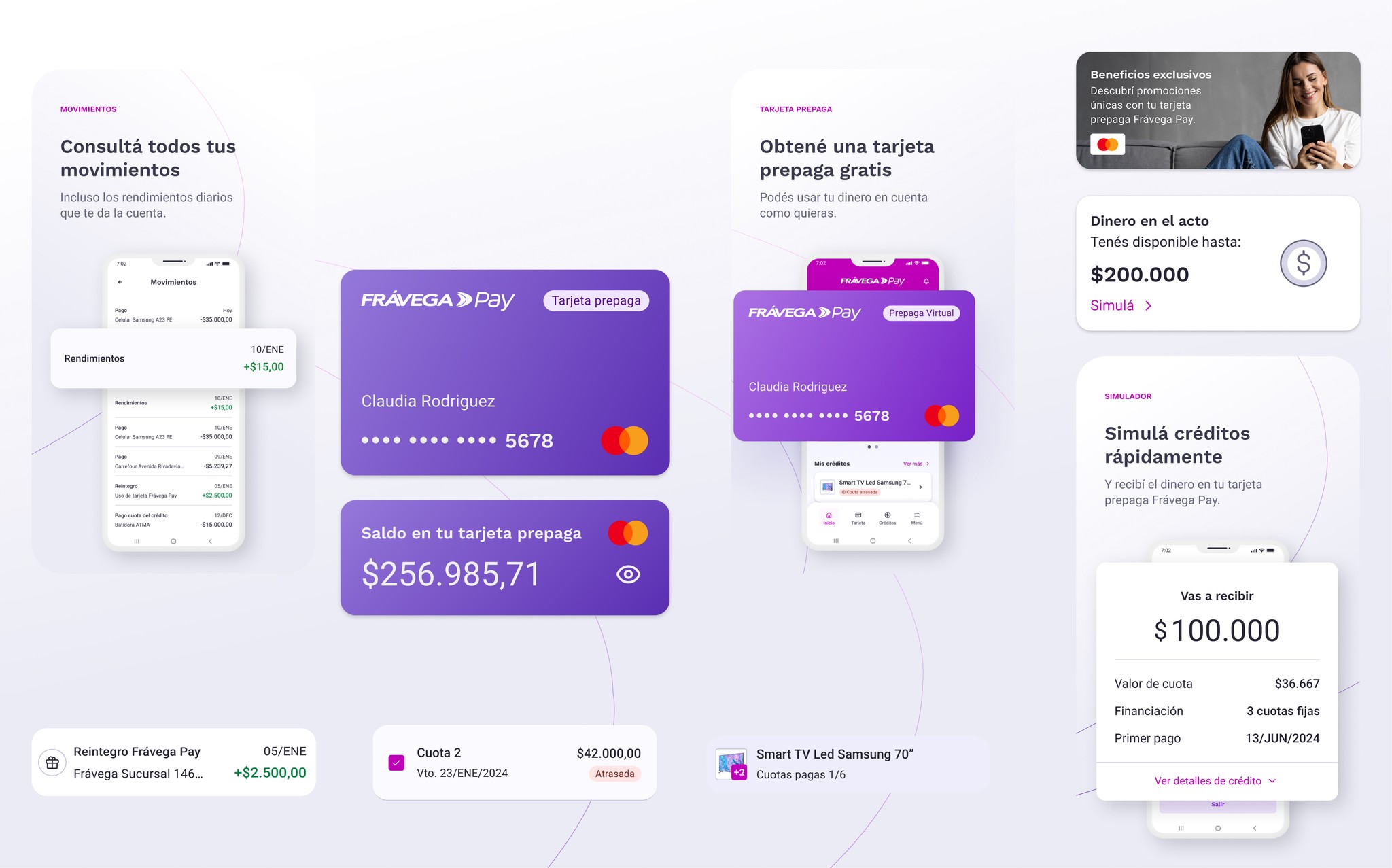

Every design decision responded to concrete needs identified through research and benchmarking. The result was a clear and trustworthy UI, built to guide users through their very first fully digital financial experience with Frávega.

Adapting the Design System

Frávega’s visual system, originally designed for web, was adapted to the mobile environment. New app-specific components were created—such as inputs, validation states, and cards—and fully documented for development.

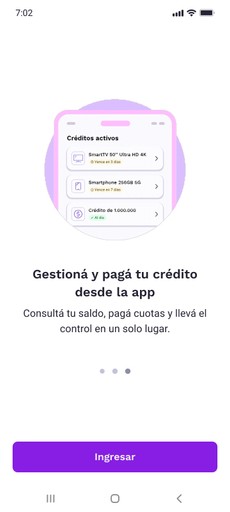

Onboarding

A simple, guided onboarding with clear messages and instant feedback at every step.

Impact: Reduced friction during the first experience and increased trust in digital credit.

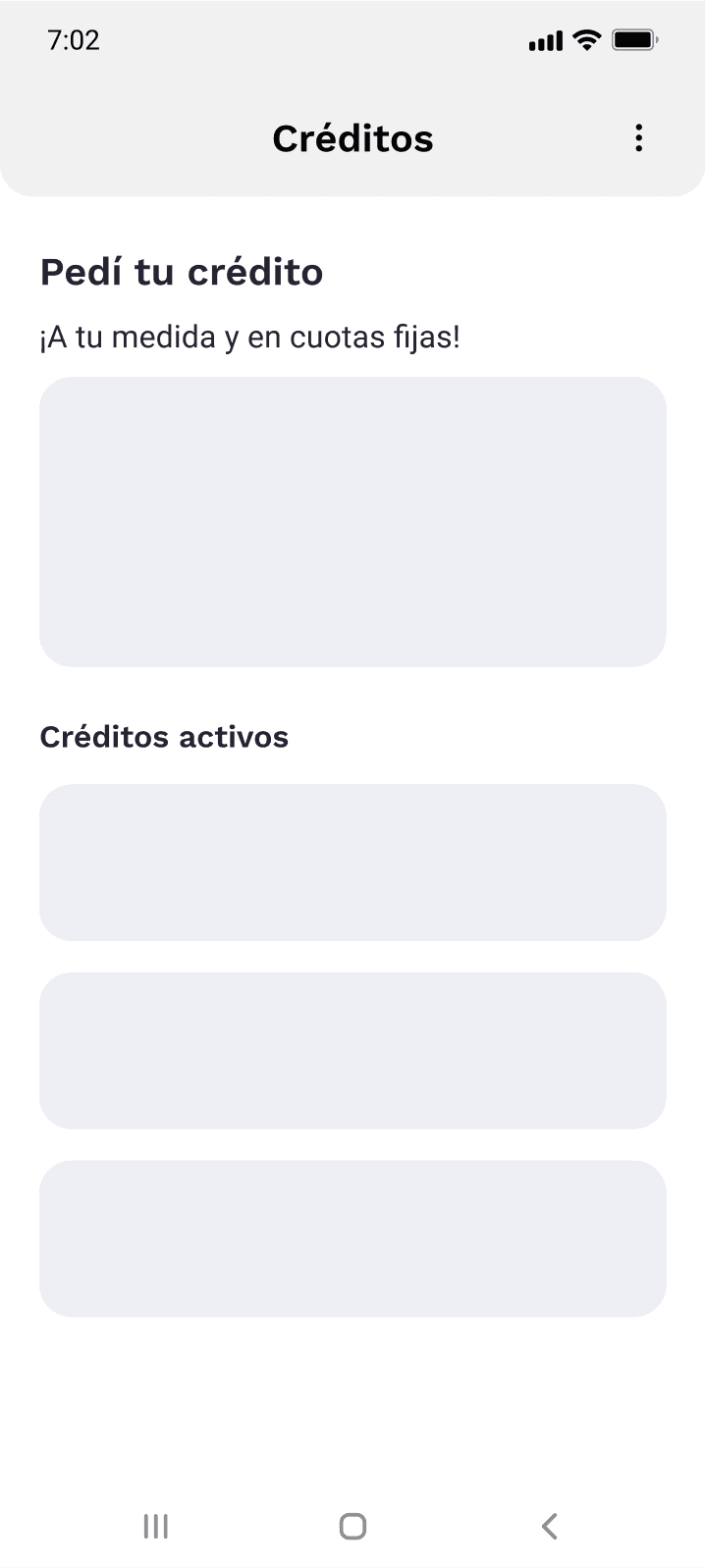

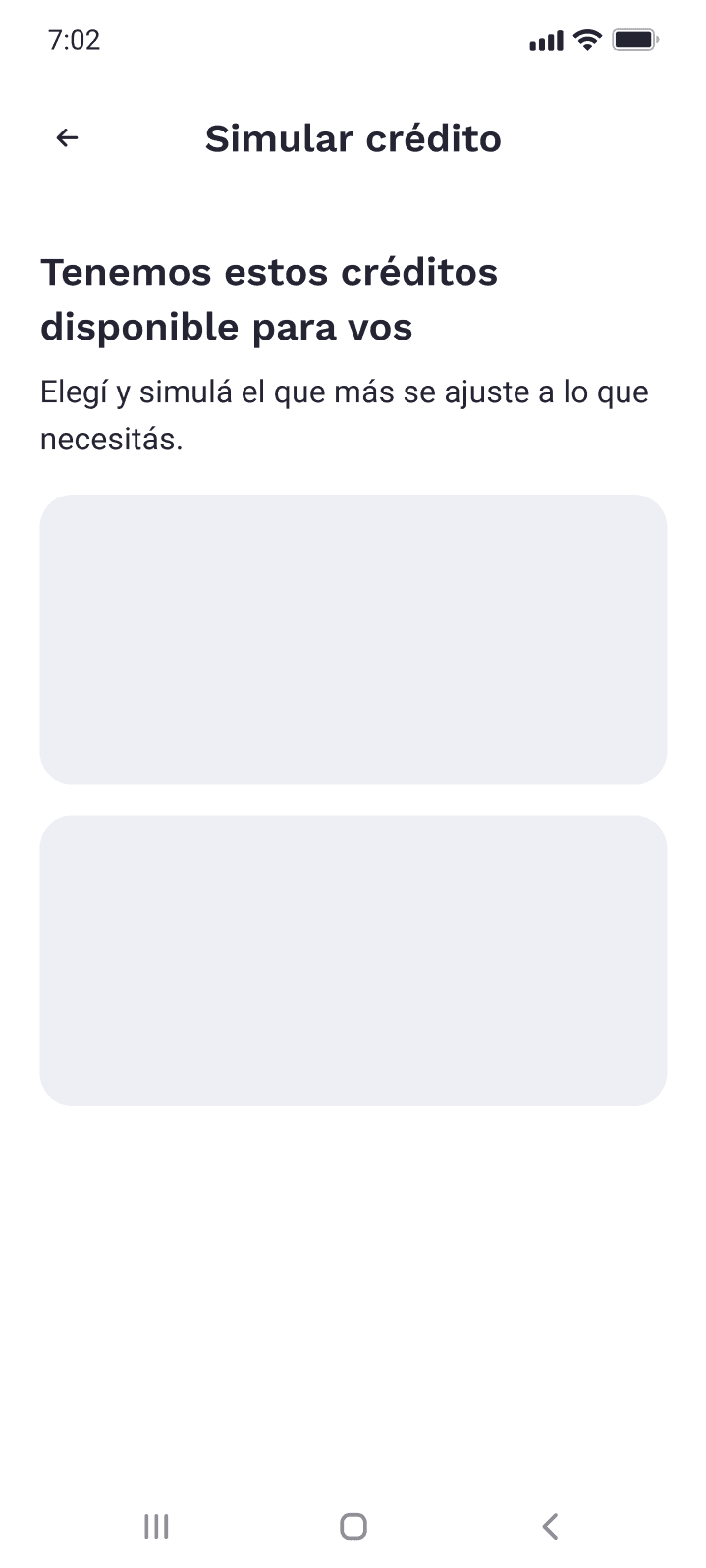

Simplified Credit Application

A three-step digital flow with amounts, limits, and conditions visible from the start.

Impact: Enabled credit validation in minutes, without the need for physical presence.

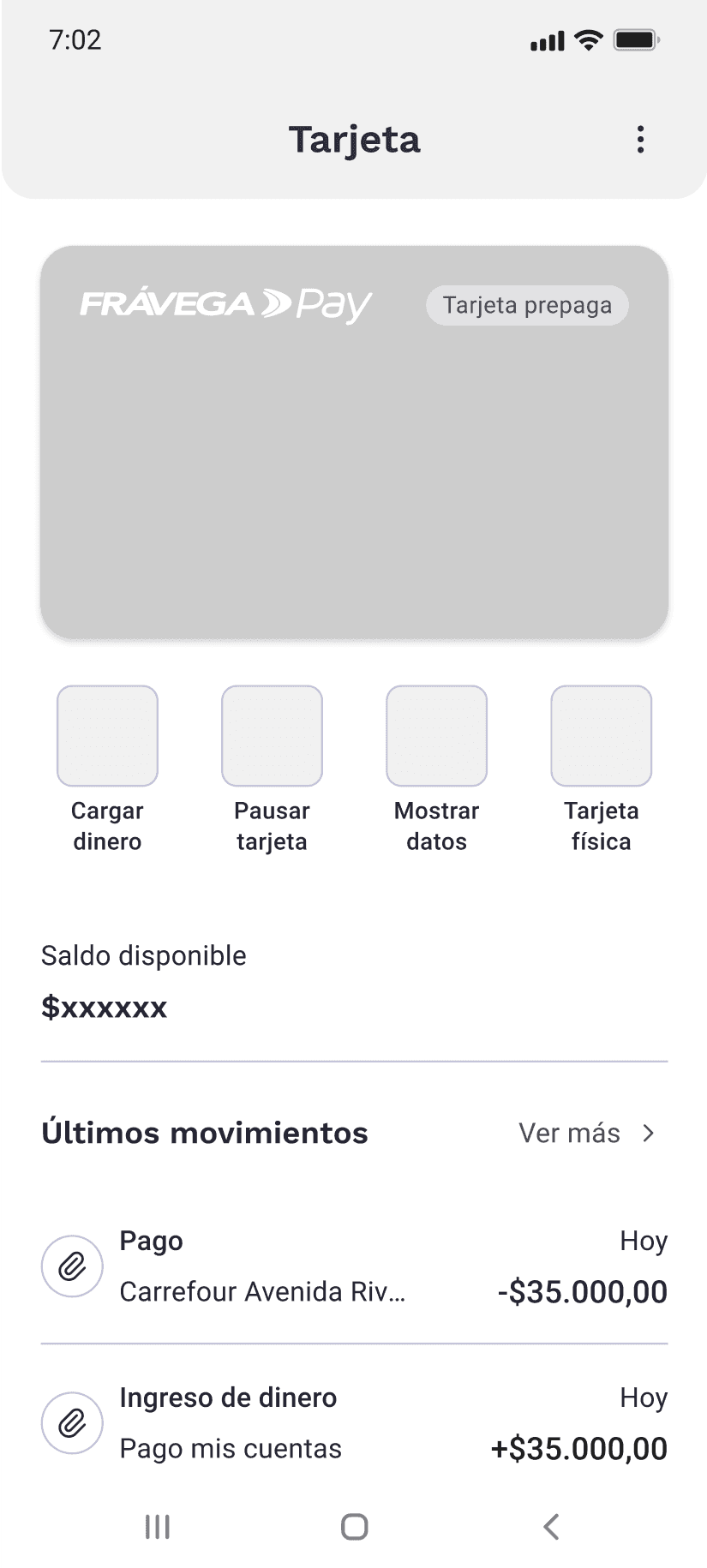

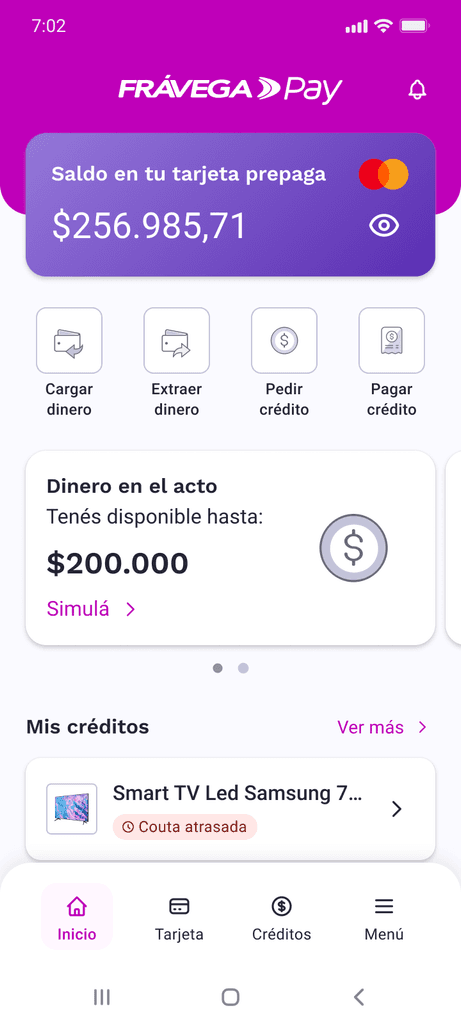

Prepaid Card as a Tangible Bridge

Design of a physical prepaid card, seamlessly integrated with the app.

Impact: Facilitated the cultural transition from physical to digital, acting as a symbol of security.

Competitive Balance Top-Up

A flow designed to support top-ups through aliases, aligned with market standards.

Impact: Laid the foundation for the product to compete with leading digital wallets.

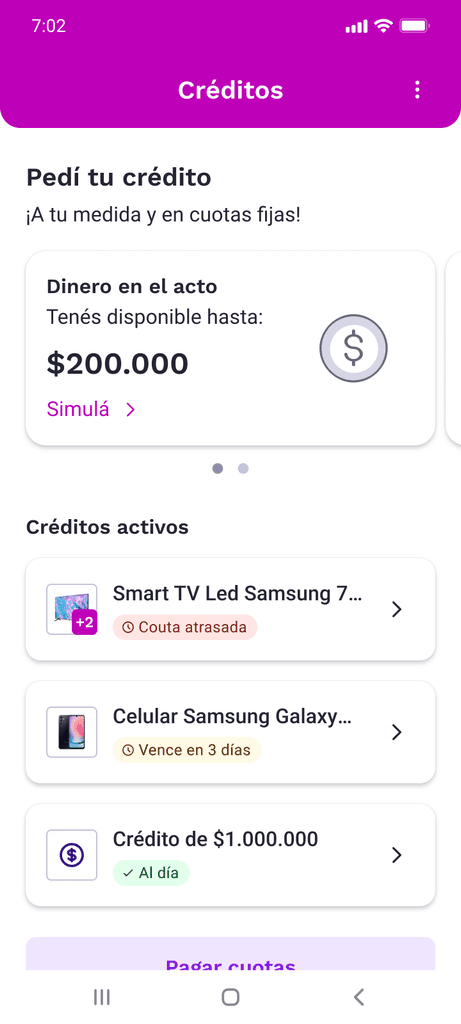

Transparent Installment Management

An installment module with clear states (active, upcoming, overdue) and detailed due dates.

Impact: Increased user confidence by giving them full control over their credit.

4.0

Results

Results

The Friends & Family phase not only validated core functionalities but also paved the way to transform a traditionally physical model into a competitive digital ecosystem.

Discovery

Other Projects